Small & Medium Enterprises (SME)

Introduction

Small and Medium Enterprises (SMEs) serve as the backbone of Malaysia’s economic landscape, injecting vitality and dynamism into the nation’s financial framework. These enterprises contribute significantly, accounting for over one-third of Malaysia’s Gross Domestic Product (GDP). Additionally, SMEs are substantial job creators, offering employment to over four million individuals across the country. As per the Bank Negara Malaysia’s report in July 2022, Outstanding SME Financing stood at RM371 billion, constituting half of the Business Financing in Malaysia. This substantial figure underscores the invaluable role SMEs play in bolstering the Malaysian economy. To truly appreciate the impact of SMEs, we must delve into the distinctive definitions of SMEs provided by SMECorp and the Income Tax Act and understand their nuanced differences.

SMECorp’s Definition

This classification is particularly crucial for Small & Medium Enterprises (SMEs) in Malaysia, a pivotal segment that greatly contributes to the economy’s overall growth. The smecorp.gov.my provides the definitive framework for determining whether a company can be classified as an SME. Let’s delve into these criteria to provide a more comprehensive understanding of what constitutes an SME.

Criteria for Classifying SMEs:

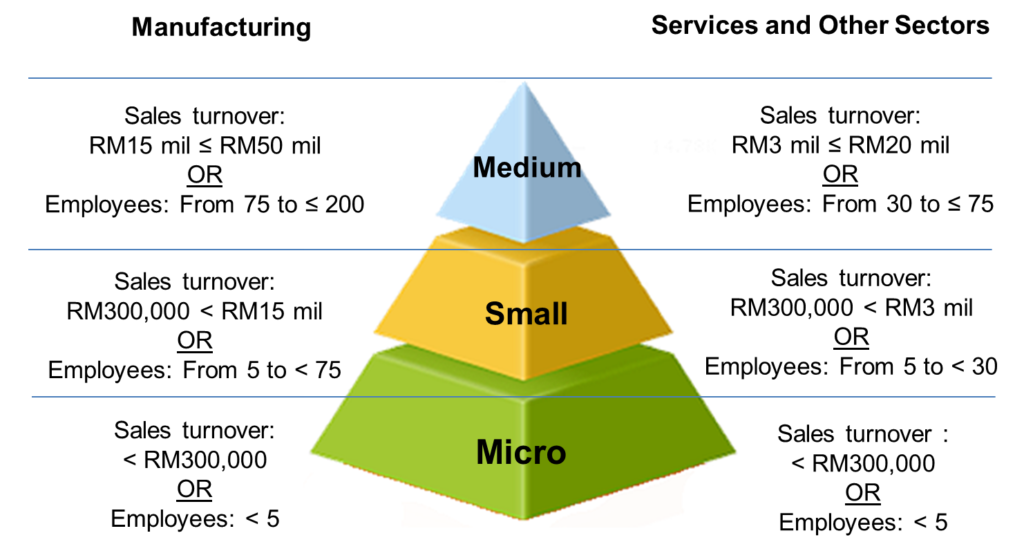

In Malaysia, the classification of an enterprise as an SME is primarily determined by two factors: the sales turnover and the number of full-time employees. The unique aspect of this categorization is that it operates on an “OR” basis, implying that meeting either the sales turnover or the employee count is sufficient to qualify a business as an SME.

| Sector | Sales Turnover | Full-time Employees |

| Manufacturing | sales turnover not exceeding RM50 million | maximum of 200 full-time employees. |

| Services and other sectors | sales turnover not exceeding RM20 million | maximum of 75 full-time employees. |

Sub-Categories within SMEs:

To further refine our understanding, SMEs are divided into micro, small, and medium enterprises, each with distinct financial and employee-based qualifiers.

In the manufacturing sector:

- Micro Enterprises: These are firms with a sales turnover of less than RM300,000 OR less than 5 full-time employees.

- Small Enterprises: The classification applies to firms with a sales turnover ranging from RM300,000 to less than RM15 million OR a count of 5 to less than 75 full-time employees.

- Medium Enterprises: Firms fall into this category if they generate a sales turnover from RM15 million to a maximum of RM50 million OR employ 75 to 200 full-time workers.

For services and other sectors, the breakdown is slightly different:

- Micro Enterprises: These businesses have a sales turnover of less than RM300,000 OR less than 5 full-time employees.

- Small Enterprises: Firms with a sales turnover from RM300,000 to less than RM3 million OR 5 to less than 30 full-time employees belong to this category.

- Medium Enterprises: The category includes firms with a sales turnover from RM3 million to not exceeding RM20 million OR a number of full-time employees from 30 to a maximum of 75.

Income Tax Approach

The categorisation of SMEs in Malaysia goes beyond the parameters set by SMECorp. An additional layer of complexity arises when we consider the Income Tax Act’s interpretation of SMEs. It’s crucial to note that the definitions and criteria used by SMECorp and the Income Tax Act may not always coincide due to their varying perspectives on different types of business setups.

For instance, SMECorp’s definition includes a wide array of business entities, such as sole proprietorships, partnerships, Limited Liability Partnerships (LLPs), and corporations. However, the Income Tax Act employs a different methodology.

Income Tax Act employs a different methodology

It’s noteworthy that under Income Tax law, a sole proprietorship is considered an individual entity and hence is subject to personal income tax regulations. Similarly, partnerships, while not directly chargeable, are assessed through the individual partners, essentially making the tax approach lean towards personal taxation.

Given this scenario, it becomes evident that the SME classification under the Income Tax Act is primarily applicable to private limited companies (Sdn Bhd) and, even to LLPs, in Malaysia.

For a company to qualify as an SME under the Income Tax Act and avail preferential tax treatment, it must fulfill three conditions:

- The Paid-Up Ordinary Share Capital at the beginning of the basis period should not exceed RM2.5 million.

- The company’s gross business income, including exempt income and income from foreign sources, must not exceed RM50 million.

- The company must not be part of a corporate group (i.e., it should not have a holding company, subsidiary, or fellow subsidiary company) with a Paid-Up Ordinary Share Capital exceeding RM2.5 million.

Unlisted Investment Holding Company

Unlisted IHCs, by their inherent business nature and per tax provisions, do not generate business. As such, these companies cannot meet the RM50 million gross business income criterion outlined in the SME classification. This inability to fulfill all the conditions essentially disqualifies unlisted IHCs from being classified as SMEs.

Therefore, an unlisted IHCs, instead of availing the preferential tax rates typically extended to SMEs, these companies will be taxed at a rate of 24%.