E-Invoice (Electronic Tax Invoice)

What’s E-Invoice and Why?

What’s E-Invoice?

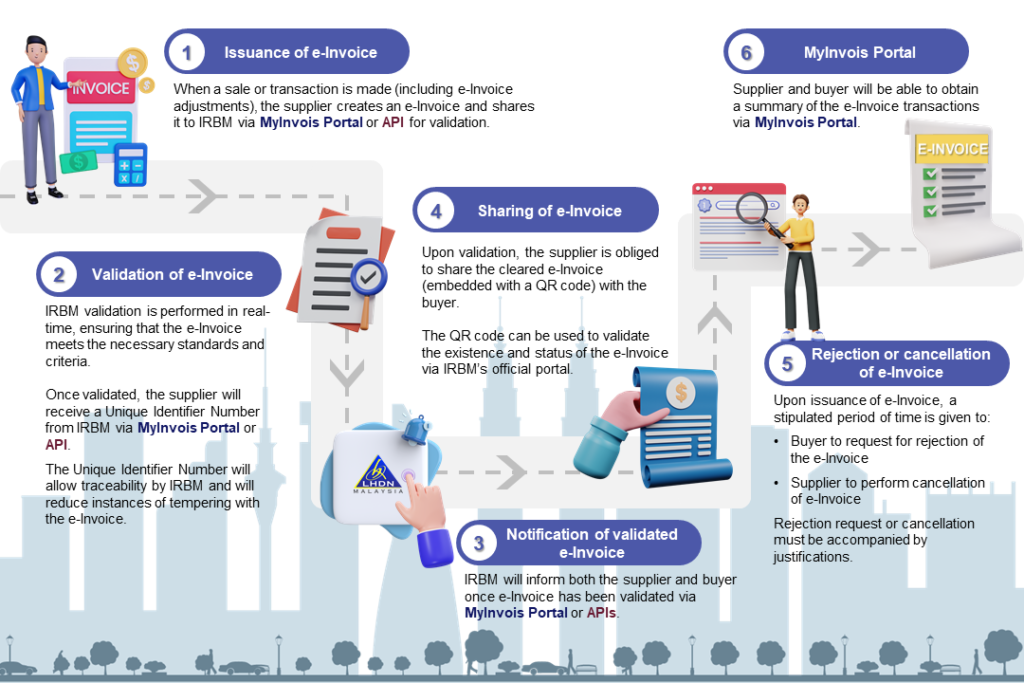

E-invoicing refers to the exchange of invoices in a structured data format between the buyer and supplier, allowing for electronic and automatic processing. This form of invoicing should be legally recognized for tax and contractual purposes, and laws must be modified to acknowledge e-invoices as valid documents.

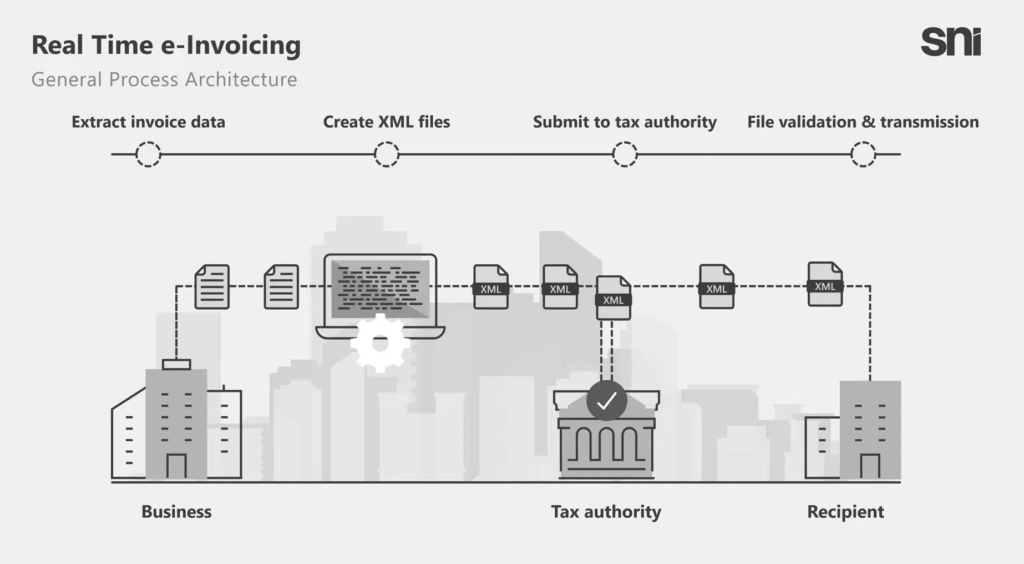

In essence, the e-invoicing system operates by businesses exporting invoice data in commonly used XML files. The tax authority then provides a digital stamp to authenticate the invoice before sending it to the recipient for processing. (You may look at the diagram below)

Why e-Invoice?

Tax Leakage: One example is “Fake Invoices” – The use of fake invoices is a common practice among businesses seeking to avoid paying taxes. By issuing fake invoices, businesses can reduce their taxable income and evade taxes, resulting in a loss of tax revenue for governments. In some cases, businesses may also manipulate the amounts on genuine invoices to reduce the tax payable.

Numerous reasons have been put forward in support of the adoption of e-invoicing systems.

- Reduction of fraudulent activities: E-invoicing reduces the possibility of fraudulent invoicing, such as issuing fake invoices or manipulating the amounts on invoices. This can significantly reduce the incidence of tax fraud, leading to increased tax compliance.

- Increased Accuracy: E-invoicing reduces the possibility of errors that often occur in manual invoicing, such as incorrect calculations or data entry mistakes. As a result, accurate invoices can lead to the correct tax amount being reported and paid, which improves tax compliance.

- Real-time monitoring: E-invoicing allows tax authorities to monitor invoices in real-time. This means that they can identify any discrepancies or inconsistencies in the invoicing process quickly, enabling them to take immediate action to rectify the issues.

Examples of South East Asia Countries adopted e-invoicing?

- Singapore was among the pioneers to introduce e-Invoicing in the ASEAN region. The mandate has been in effect since 2018 and is now compulsory for government authorities, based on the PEPPOL interoperability framework.

- Thailand introduced e-invoicing in the year of 2017, however, it is not mandatory. This voluntary Electronic Tax Invoice, also known as e-Tax Invoice, along with Electronic Receipt or e-Receipt, is a system that enables the preparation of tax invoice data electronically. This system not only covers invoices and receipts but also credit and debit notes, all of which must be generated in the required electronic format as per regulations.

- Vietnam moved into compulsory e-invoicing in the year 2018.

- Philippines too has announced its pilot project for e-invoicing in 2022.

Malaysia timeline?

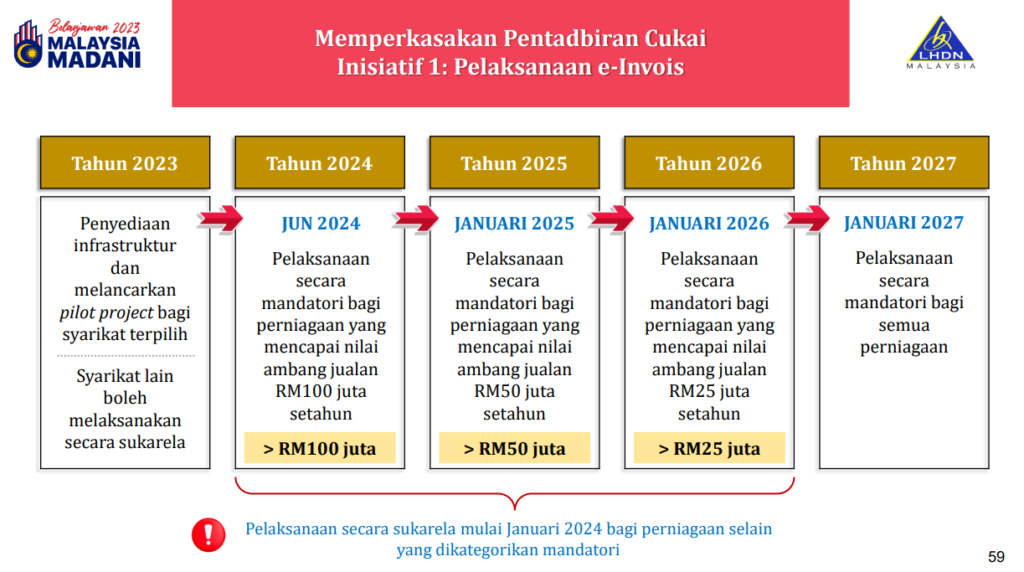

Making reference to the SPK 2023 (Held in March 2023), Malaysia is expecting mandatory e-invoicing for all businesses in January 2027.

New Updates on E-Invoicing

IRB Malaysia has released more information on E-Invoicing at its Hasil Webpage (HERE)

E-Invoice Explained Briefly

Other Budget 2023 Proposals

- Bring me to PERSONAL TAX PROPOSALS

- Bring me to CORPORATE & BUSINESS TAX PROPOSALS

- Bring me to STAMP DUTY & RPGT PROPOSALS

- Bring me to E-Invoicing

Struggling with accounting problems?

Let CA Low & Co be your solution to cloud-based outsourcing solution for your accounting needs and stay ahead in today’s modern world. Find out More